If you think about which share will be best for investment in recent times then you should know about IFCI Share Price Target. Today in our blog we will explain the basic idea about the IFCI Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

IFCI Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly. We use expert data and analysis to understand the IFCI Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s look at the IFCI Share Price Target 2024 to 2040.

What Is IFCI Limited Company?

IFCI Limited Company, formerly known as Industrial Finance Corporation Of India, is under the Ministry Of Finance. The company was established in the year 1948. The company provides financial support to the different types of Industries.

Overview Of IFCI Limited Company

The financial activities support different types of projects like airports, Power, Real Estate, Telecom, Services Sector, etc. The company completed projects like GMR Goa International Airport, NRSS Transmission, Adani Mundra Ports, Raichur Power Corporation, etc.

| Company Name | Industrial Finance Corporation Of India |

| Market Cap | ₹15,456.89 Crore |

| Book Value | ₹5.20 |

| Face Value | ₹10 |

| 52 Week High | ₹72.52 |

| 52 Week Low | ₹11.45 |

| P/B | 12 |

| DIV. YIELD | 0% |

Also Read – Top 10 long term stocks in India as per market capitalisation

Financial Data Analysis Of IFCI Company

Before investing any share anyone wants to see the company’s performance, overall profit, and net sales amount. We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. IFCI Share Price Target also depended upon the ratio which is described below.

| PE Ratio | Return On Assets (ROA) | Current Ratio | Return On Equity (ROE) |

| 115.24 | 1.90% | 7.33 | 2.83% |

History Of IFCI Share Price Target 2024 to 2040

IFCI Share is a bullish trend in the share market. IFCI Share is under both the Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last 6 Months’ share growth was +30.75 (113.26%), the last 1 year’s share growth was +46.15 (392.77%), the last 5 year’s share growth was +48.90 (543.33%) and the maximum share growth was +41.05 (242.63%).

IFCI Share Price return percentage was 38.25% in the last 3 months, the last 1 year’s share price return percentage was 375.10%, the last 3 year’s share price return percentage was 309.25%, and the last 5 year’s share price return percentage was 541.25%. IFCI Share always gives returns to investors. If anyone wants to invest in the share it will be profitable on a long-term basis.

IFCI Share Price Target 2024

The IFCI company provides financial support facilities through Project Finance, Corporate Finance & Structured Finance Sector, and Services & Agro Based Sector. Under Project Finance the company provides financial support in different sectors like Power, TeleCommunication, Road, Textile Industry, etc. Under Corporate Finance the company provides the company offers short-time loans to handle business requirements.

| Year | IFCI Share Price Target 2024 |

| 1st Price Target | 60.25 |

| 2nd Price Target | 105.96 |

The Profit growth of the company has increased to a high level in the last 1 year. The last 3 year’s profit growth was -1.20% which increased to 86.25% in the last 1 year. The net profit growth was ₹84.25 Crore in September 2023 which increased to ₹216.23 Crore in March 2024. The IFCI Share Price Target 2024 forecast, the 1st Price Target is ₹60.25 and the 2nd Price Target is ₹105.96.

IFCI Share Price Target 2025

IFCI company also works for Government Advisory services. For the Government Advisory Service, the company acts as a Project Managment Agency (PMA) which is linked to different Incentive Schemes. Under the Corporate Advisory, the company offers ESG Advisory and another corporate advisory. The company is also working as a nodal agency to monitor the loan of Sugar Development Funds (SDF) from the year 1984.

| Year | IFCI Share Price Target 2025 |

| 1st Price Target | 125.74 |

| 2nd Price Target | 180.23 |

The income growth of the company is not so good. The last 3 years’ income growth was -39.25 % which decreased to -29.98%. The operating income was ₹758.52 Crore in March 2022 which decreased to ₹536.14 Crore in March 2023. The other income amount was ₹57.12 Crore in March 2022 which increased to ₹92.12 Crore in March 2023. The IFCI Share Price Target 2025 forecast, the 1st Price Target is ₹125.74 and the 2nd Price Target is ₹180.23.

IFCI Share Price Target 2027

IFCI Company works as an intermediary in different niche areas like entrepreneurship development organizations, consultancy organizations, educational and skill development institutes, stock exchanges, and many other fields. The Balance Sheet Size amount was ₹9,123 Crore in the year 2021-22 which became ₹8,989 Crore in the year 2022-23. The company’s regional office is also located in Pune, Jaipur, Bengaluru.

| Year | IFCI Share Price Target 2027 |

| 1st Price Target | 260.45 |

| 2nd Price Target | 305.93 |

The total revenue of IFCI Company was ₹546.27 Crore in March 2023 which became ₹896.52 Crore in March 2024. The total operating revenue was ₹536.47 Crore in March 2023 which increased to ₹841.69 Crore in March 2024. The IFCI Share Price Target 2027 forecast, the 1st Price Target is ₹260.45 and the 2nd Price Target is ₹305.93.

IFCI Share Price Target 2030

The IFCI Company’s 50% share of the capital is held by IDBI and the other 50% is held by banks, corporate banks, insurance companies, investment trusts, etc. IFCI Company has been authorized by the Industrial Finance Corporation Act (1982) which provides technical & administrative assistance to industries for the promotion, management, or expansion of different industries.

| Year | IFCI Share Price Target 2030 |

| 1st Price Target | 405.89 |

| 2nd Price Target | 465.74 |

As the company is a very old company and has a good market value the promoter’s holding capacity of the company is very good which is 70.85% which means many good investor wants to invest in the share. The ROCE percentage of the company was 0.57% in the last 5 years which decreased to -2.96% in the last 3 years and it became 6.89% in the last 1 year. In the IFCI Share Price Target 2030 forecast, the 1st Price Target is ₹405.89 and the 2nd Price Target is ₹465.74.

Also Read – IRFC Share Price Target for 2024, 2025, 2027, 2030 – 2035 (Long Term)

IFCI Share Price Target 2040

| Year | IFCI Share Price Target 2040 |

| 1st Price Target | 1,260.85 |

| 2nd Price Target | 1,340.56 |

The tax amount was ₹35.12 Crore in December 2023 which increased to ₹114 Crore in March 2024. The total Assets amount was ₹7,236.85 Crore in March 2022 which decreased to ₹7,180 Crore in March 2023. In the IFCI Share Price Target 2040 forecast, the 1st Price Target is ₹1,260.85 and the 2nd Price Target is ₹1,340.56.

Peer’s Company of IFIC Limited

- Gold Line

- Emerald Finance

- Power Finance

- RFC

- CGCL-RE

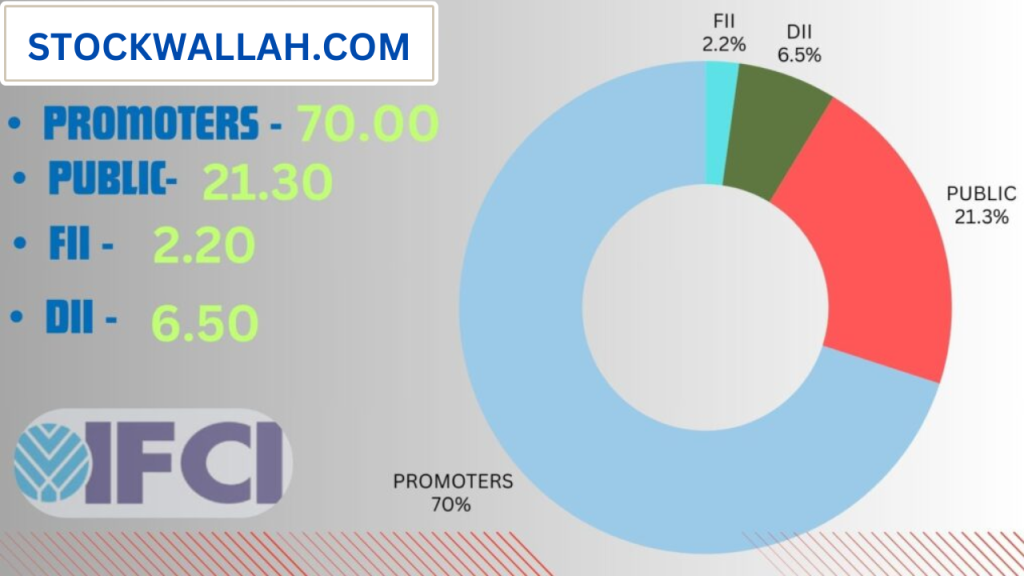

Investors Types And Ratio Of IFIC Limited

There are mainly Four main Types of Investors in IFIC Limited. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (company owner) through overall capital. IFIC Limited Company’s promoter holding capacity is 70.00%.

Public Holding

Public Investors are individuals who invest in the public market profit in the future (large and small companies). IFIC Limited Company’s public holding capacity is 21.30%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. IFIC Limited Company’s FII is 2.20%.

DII

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. IFIC Limited Company’s DII is 6.50%.

Advantages and Disadvantages Of IFIC Share

Every share has some advantages and some disadvantages also. So, the IFIC Share Price Target also has some advantages and disadvantages described below.

Advantages

- The Company has a good promoter holding capacity which is 70.00%.

- The Book Value amount per share has improved in the last 2 years.

- The net cash flow amount of the company improving.

Disadvantages

- The ROE percentage of the company is very poor which is -100.74% in the last 3 years.

- The profit growth of the company is very bad which is -1.20% in the last 3 years.

- The ROCE percentage of the company is very bad which is -2.95% in the last 3 years.