If you think about which share will be best for investment in recent times then you should know about PNB Share Price Target. Today in our blog we will explain the basic idea about the PNB Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

PNB Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly. We use expert data and analysis to understand the PNB Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s look at the PNB Share Price Target 2024 to 2040.

What Is PNB Limited?

The full form of PNB is Punjab National Bank which is an Indian Government Public Sector Bank that was established in the year 1894. The main branch of the company is situated in New Delhi. The total customer number of the company is 190 million.

Overview Of PNB Limited

The PNB has 13,354 branches and more than 1,4000 ATMs in overall India. It has also a banking subsidiary in the UK where there are 7 branches. IN Nepal PNB has 123 branches. Punjab National Bank is an Indian Public Sector which is under the Government Of India which was registered under the Indian Companies Act in the year 1894.

| Company Name | PNB Limited |

| Market Cap | ₹1,42,992.96 Crore |

| Book Value | ₹90.12 |

| Face Value | ₹2 |

| P/B | 1.43 |

| 52 Week High | ₹143.52 |

| 52 Week Low | ₹49.70 |

| DIV. YIELD | 1.20% |

Financial Data Analysis Of PNB Limited

We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. PNB Limited Share Price Target also depended upon the ratio described below.

| PE Ratio | Return On Assets (ROA) | CASA Ratio | Return On Equity (ROE) |

| 16.12 | 0.56% | 40.80% | 8.94% |

History Of PNB Share Price Target From 2024 to 2040

PNB Share is a bullish trend in the share market. PNB Share is under both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last 6 Month’s share growth was +38.15 (43.28%), the last 1 year’s share growth was +74.89 (145.30%), the last 5 year’s share growth was +49.84 (64.94%) and the maximum share growth was +49.98 (65.07%).

PNB Share Price return percentage was 1.96% in the last 1 month, the last 1 year’s share price return percentage was 146.85%, the last 3 year’s share return percentage was 201.56% and the last 5 year’s share return percentage was 60.78%. PNB Share always gives a good return to investors. If anyone wants to invest it will be profitable on a long-term basis.

Also Read – IFCI Share Price Target 2024, 2025, 2027, 2030, 2040

PNB Share Price Target 2024

Panjab National Bank is an Indian Government bank that has a total of 80 million customers has more than 10781 ATMs in 765 cities overall India. The PNB Bank provides different types of loans like Housing Loans, Educational Loans, Vehicle Loans, Personal Loans, etc. PNB Bank provides Housing loans for Government Employees and the general public. The Bank provides personal loans for the Public Personal Loan Scheme, a loan scheme for pensioners, etc.

| Year | PNB Share Price Target 2024 |

| 1st Price Target | 120.78 |

| 2nd Price Target | 180.96 |

The net profit growth of the company was₹2,647.89 Crore in March 2023 which increased to ₹8,356.74 Crore in March 2024. The operating expenses amount was ₹6,789.45 Crore in December 2023 which increased to ₹8,745.99 Crore in March 2024. If we look at PNB Share Price Target 2024 forecast, the 1st Price Target is ₹120.78 and the 2nd Price Target is ₹180.96.

PNB Share Price Target 2025

PNB Bank also provides loans for farmers through the Agriculture Loan Scheme, Digital Agriculture Loan Products, Central Agricultural Loan Scheme, etc. PNB also provides Vehicle Loans for Government Employees and normal public also. PNB Sartthi Scheme which provides financial loans for two-wheelers like Motor Cycle, Scooter, etc. Another One is the PNB Power Ride Scheme for purpose new two-wheelers.

| Year | PNB Share Price Target 2025 |

| 1st Price Target | 205.74 |

| 2nd Price Target | 285.93 |

The ROE percentage of the company is not so good which was 3.95% in the last 5 years which decreased to 5.74% in the last 3 years and became 8.96% in the last 1 year. The company is a very old company and the company is trustable to customers the promoter holding capacity of the company is outstanding which is 73% to 74% which means many good investor wants to invest in the share. If we look at PNB Share Price Target 2025 forecast, the 1st Price Target is ₹205.74 and the 2nd Price Target is ₹285.93.

PNB Share Price Target 2027

PNB also provides banking facilities through PNB Retail Internet Banking in which anyone can access banking facilities through the Internet. Through Internet Banking, customers can get facilities like opening new accounts, Positive Pay Services, changing account variants, Change Home Branches, etc. Through the E-Statement facility of PNB customers can access the account transaction details through the Internet.

| Year | PNB Share Price Target 2027 |

| 1st Price Target | 385.12 |

| 2nd Price Target | 450.54 |

The Net Interest Margin (NIM) was 2.48% in the last 5 years which became 2.54% in the last 3 years which became 2.17% in the last 1 year. The ROA percentage of the company is not very good, in the last 5-year share growth was 0.35% which became 0.35% in the last 3 years, and in the last 1 year, it became 0.68%. If we look at PNB Share Price Target 2027 forecast, the 1st Price Target is ₹385.12 and the 2nd Price Target is ₹450.54.

PNB Share Price Target 2030

PNB also provides Life Insurance and General Insurance Facilities. PNB has made up a tie-up with 5 insurance companies Oriental Insurance Co. Ltd, Care Health Insurance Ltd, Star Health and Allied Insurance Corporation Ltd, etc. The Government Of India nationalized PNB in the year 1969. The PNB also caters to pension facilities for Central Civil, Defence, Telecom, State Government, Postal, etc.

| Year | PNB Share Price Target 2030 |

| 1st Price Target | 630.54 |

| 2nd Price Target | 700.26 |

The net revenue amount of the company was ₹30,456.89 Crore in the year 2023 which became ₹33,145.23 Crore in March 2024. The Net NPA percentage of the company was 3.96% in the last 5 years which decreased to 2.75% in the last 3 years and in the last 1 year it became 0.75%. If we look at PNB Share Price Target 2030 forecast, the 1st Price Target is ₹630.54 and the 2nd Price Target is ₹700.26.

Also Read – Best Short Term Stocks in 2024

PNB Share Price Target 2040

PNB also provides Educational loan facilities like PNB Saraswati and PNB Pratibha which provides loan facilities for educational purposes. In 2022 PNB will provide a WhatsApp banking facility for customers and non-customers. PNB also provides Gold Loan Services to customers which is an advance scheme facility for Gold Jewelry.

| Year | PNB Share Price Target 2040 |

| 1st Price Target | 1550.36 |

| 2nd Price Target | 1645.96 |

The tax amount of the bank was ₹879.69 Crore in March 2023 which increased to ₹29,456.23 Crore in March 2024. The other income amount was ₹3,652.41 Crore in March 2023 which became ₹4,385.12 Crore in March 2024. If we look at PNB Share Price Target 2040 forecast, the 1st Price Target is ₹1550.36 and the 2nd Price Target is ₹1645.96.

Peer’s Company of PNB Limited

- Allahabad Bank

- Bank Of Baroda

- Bank Of India

- Canara Bank

- Central Bank

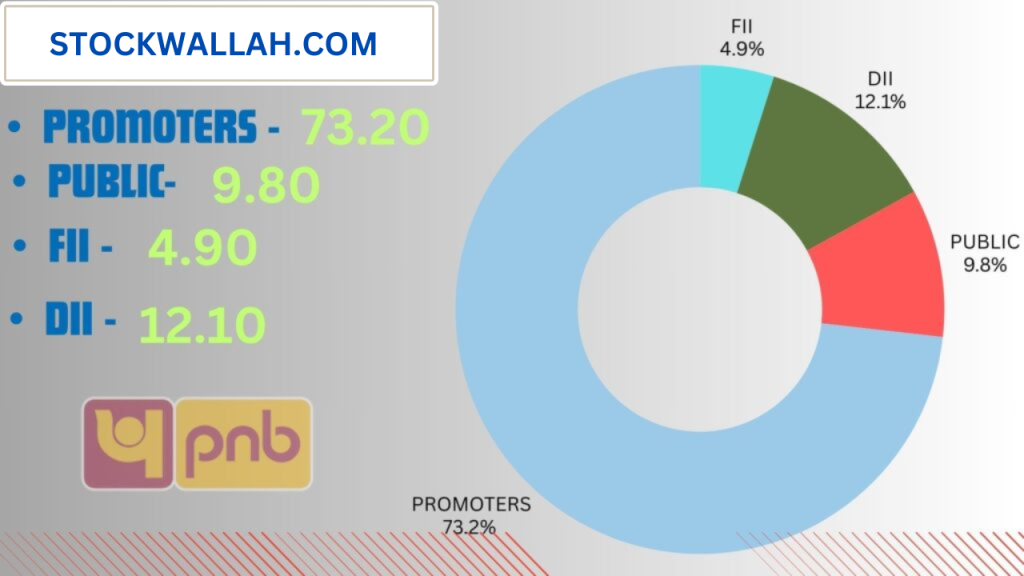

Investors Types And Ratio Of PNB Limited

There are mainly Four main Types of Investors in PNB Limited. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (company owner) through overall capital. PNB Limited Company’s promoter holding capacity is 73.20%.

Public Holding

Public Investors are individuals who invest in the public market profit in the future (large and small companies). PNB Limited Company’s public holding capacity is 9.80%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. PNB Limited Company’s FII is 4.90%.

DII

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. PNB Limited Company’s DII is 12.10%.

Advantages and Disadvantages Of PNB Share

Every share has some advantages and some disadvantages also. So, the PNB Share Price Target also has some advantages and disadvantages described below.

Advantages

- The company has a good profit growth which is 59.90% in the last 3 years.

- The company has a good capital adequacy which is 16.25%.

- CASA stands for 41.25% of its total deposits.

- The book value amount of the company also increased in the last 2 years.

- The promoter holding capacity of the company is very good which is 73.20%.

Disadvantages

- The ROA percentage of the company is not very good which was 0.35% in the last 3 years.

- The ROE percentage of the company was 5.74% in the last 3 years.

- The income ratio of the company is very high which is 54.12%.