If you’re thinking about which shares are good for investment right now, you should know about the REC Ltd share price target. In today’s blog, we will explain the basics of REC Ltd’s share price target for the years 2024, 2025, 2027, 2030, and 2040. We have researched and taken advice from experts to write about the company’s growth, performance, and more.

REC Ltd is a company traded in the stock market. In this article, we will talk about the company’s financial growth, its business policies, its shareholding pattern, and the yearly forecast of its share prices. We use expert data and analysis to understand the REC Ltd share price target. This article is helpful for anyone thinking about investing in this share right now. Let’s take a look at the REC Ltd share price target from 2024 to 2040.

What Is REC Limited Company?

REC Limited stands for Rural Electrification Corporation Limited. It is under the Ministry of Power, Government of India. The company gives financial support to power projects and was established in 1969.

Overview Of REC Limited Company

REC Limited provides loans to central and state electricity sectors such as State Electricity Boards, Rural Electric Cooperatives, Private Power Developers, and NGOs. Recently, REC Limited has also started working in other sectors like non-power infrastructure and logistics, including airports, metro systems, ports, and bridges.

Also Read : Best penny stocks to buy today india for long term

| Company Name | REC Limited Company |

| Market Cap | ₹1,32,958.68 Crore |

| Face Value | ₹263.54 |

| Book Value | ₹10 |

| 52 Week High | ₹614.52 |

| 52 Week Low | ₹148.85 |

| P/B | 1.10 |

| DIV. YIELD | 3.25% |

History Of REC Ltd Share From 2024 to 2040

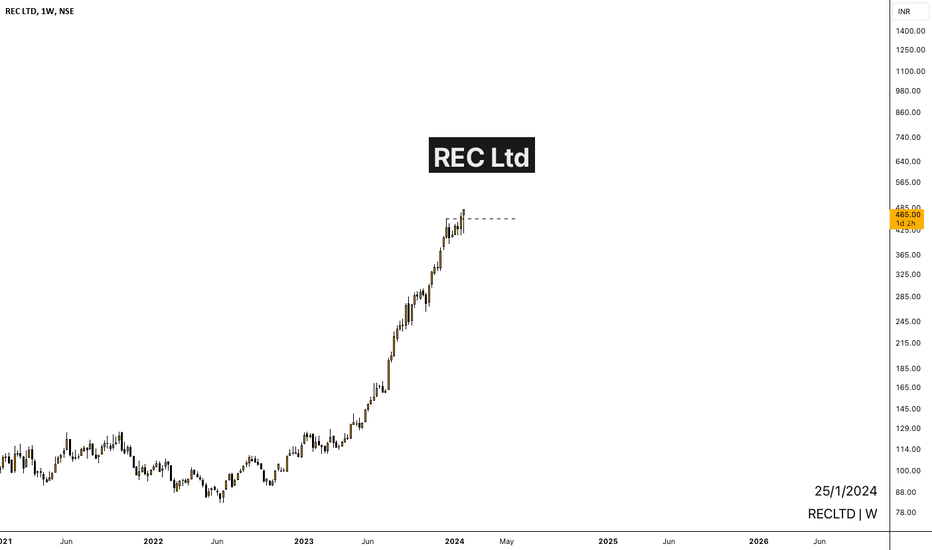

REC Ltd shares are currently in a bullish trend. They are listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Over the last 6 months, the share price increased by +87.55 (21.44%). In the last year, it grew by +341.30 (220.76%). Over the past 5 years, the share price went up by +378.41 (322.08%). The maximum share growth recorded was +453.73 (1,075.95%).

In the last 3 months, REC Ltd shares returned 6.23%. Over the last year, the return was 234.58%. In the past 3 years, the share price increased by 309.85%, and over the last 5 years, it went up by 335.85%. REC Ltd shares always give good returns to investors. If anyone wants to invest, it will be profitable in the long term.

REC Ltd Share Price Target 2024

REC Ltd provides essential support for improving power transmission, sub-transmission, and distribution systems. The company also invests in renovating and modernizing the Rural Electrification System. To do this, REC Ltd has 13 Project Offices and 5 Zonal Offices that deliver these services. The company’s headquarters is in New Delhi.

| Year | REC Ltd Share Price Target 2024 |

| 1st Price Target | 490.12 |

| 2nd Price Target | 586.95 |

Over the past 5 years, the company’s profit growth was 21.02%, which increased to 32.25% over the last 3 years, and in the last year, it reached 11.25%. The net profit of the company was ₹3,125.85 Crore in March 2023 and rose to ₹4,228.89 Crore in March 2024. Looking at the REC Ltd Share Price Target for 2024, the first Price Target is ₹490.12 and the second Price Target is ₹586.95.

REC Ltd Share Price Target 2025

REC Ltd also offers financial support for renewable energy sources such as Thermal Power Projects, Hydro Power Projects, and Solar Power Projects. In addition to this, the Government of India launched the Deen Dayal Upadhyaya Gram Jyoti Yojana in 2014 to electrify rural areas. Subsequently, the Saubhagya scheme was launched in 2017 to electrify both rural and urban areas. As of recent times, 98.5% of Indian households have been electrified.

| Year | REC Ltd Share Price Target 2025 |

| 1st Price Target | 590.25 |

| 2nd Price Target | 685.36 |

Over the past 5 years, the company’s ROE percentage was 19.52%, which increased to 21.96% over the last 3 years, and in the last year, it reached 20.96%. The ROCE percentage was 9.25% over the past 5 years, which improved to 9.86% over the last 3 years, and in the last year, it rose to 20.58%. Looking ahead to the REC Ltd Share Price Target for 2025, the first Price Target is ₹590.25 and the second Price Target is ₹685.36.

REC Ltd Share Price Target 2027

REC Ltd Company operates through 22 state offices to ensure efficient service delivery. One of the significant rural development schemes is the Saubhagya Pradhan Mantri Sahaj Bijli Har Ghar Yojana, which aims for universal household electrification, covering every village and district nationwide. The total budget for the scheme is ₹16,456 Crore, with a gross budgetary support of ₹12,420 Crore.

| Year | REC Ltd Share Price Target 2027 |

| 1st Price Target | 905.96 |

| 2nd Price Target | 1145.21 |

In March 2023, REC Ltd had total revenue of ₹39,745.25 Crore, which grew to ₹48,385.89 Crore by March 2024. The total operating revenue also increased from ₹40,158.96 Crore in March 2023 to ₹48,256.74 Crore in March 2024. Looking ahead to the REC Ltd Share Price Target for 2027, the first target is ₹905.96 and the second target is ₹1145.21.

REC Ltd Share Price Target 2030

Another important scheme is the Deen Dayal Upadhyaya Gram Jyoti Yojana. Under this scheme, the Government of India provides 60% of the total project cost (85% for special states). Additional grants of up to 15% are available (with 5% allocated for special category states). Over the past 10 years, the company has completed projects in 191,956 villages. Additionally, REC Ltd is involved in the Tehri Dam project, generating hydroelectric power.

| Year | REC Ltd Share Price Target 2030 |

| 1st Price Target | 1789.56 |

| 2nd Price Target | 1952.78 |

The income growth percentage was 11.98% which decreased to 9.99% in the last 3 years and in the last 1 year it decreased to 0.20%. The other income amount was ₹10.80 Crore in March 2023 which increased to ₹31.25 Crore in March 2024. If we look at the REC Ltd Share Price Target 2030 forecast, the 1st Price Target is ₹1789.56 and the 2nd Price Target is ₹1952.78.

The company’s income growth rate was 11.98%, which dropped to 9.99% in the past 3 years and fell to 0.20% in the last year. Other income amounted to ₹10.80 Crore in March 2023, increasing to ₹31.25 Crore by March 2024. Looking ahead to REC Ltd’s Share Price Target for 2030, the first target is ₹1789.56 and the second target is ₹1952.78.

REC Ltd Share Price Target 2040

The Tehri Dam is 855 feet tall and 1,886 feet long. It provides electricity to Rajasthan, Uttarakhand, Punjab, Uttar Pradesh, Himachal Pradesh, and Chandigarh. The dam can generate 1000 MW of hydro power. In Uttarakhand, the company’s project produces 12% of the state’s electricity, which is given to the State Government at no cost.

| Year | REC Ltd Share Price Target 2040 |

| 1st Price Target | 3,854.96 |

| 2nd Price Target | 4,078.32 |

In March 2022, the tax amount was ₹2,378.96 Crore, which rose to ₹2,856.14 Crore by March 2023. The profit before tax was ₹10,456.96 Crore in March 2022 and increased to ₹11,456.85 Crore by March 2024. Looking ahead to REC Ltd’s Share Price Targets for 2040, the first target is ₹3,854.96 and the second target is ₹4,078.32.

How To Purchase REC Ltd Share?

The most common trading platform for purchasing the REC Ltd Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Investors Types And Ratio Of REC Ltd

There are mainly Four main Types of Investors in REC Ltd. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (company owner) through overall capital. REC Ltd Company’s promoter holding capacity is 52.70%.

Public Holding

Public Investors are individuals who invest in the public market profit in the future (large and small companies). REC Ltd Company’s public holding capacity is 11.40%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. REC Ltd Company’s FII is 20.50%.

DII

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. REC Ltd Company’s DII is 15.40%.

Advantages and Disadvantages Of REC Ltd Share

Every share has some advantages and some disadvantages also. So, the REC Ltd Share Price Target also has some advantages and disadvantages described below.

Advantages

- The company has a healthy ROE ratio which is 21.96%.

- The company has a good promoter holding capacity of 52.70%.

- The book value amount increased per share in the last year.

- The company has a low amount of debt.

- The company is increasing with zero promoter pledges.

Disadvantages

The poor cash generated from the core business.